Last Updated 25/11/2024 published 28/09/2020 by Hans Smedema

Page Content

Embargo and again(!) cancelled Spanish Bank Account

Unbelievable, but again the Spanish Agencia Tributaria has put an embargo on my new Spanish Openbank account(specific for paying taxes), after they did that in 2018 also with my Bankinter account. Making paying taxes impossible themselves!

Unbelievable, but again the Spanish Agencia Tributaria has put an embargo on my new Spanish Openbank account(specific for paying taxes), after they did that in 2018 also with my Bankinter account. Making paying taxes impossible themselves!

I do not have any money, only my monthly pension from the Dutch State and a bit more. Total 1550 a month or so before taxes. From that I have to live on 100 a month or so after paying fixed costs. So saving any money is difficult, specific as I still have to defend myself against the Dutch persecution and have some extra costs for my blog and a server, keeping a computer and cheap mobile phone, and of course extra costs for all the follow up damages caused by the secret Royal Dutch cover-up and conspiracy. The largest ever in the history of the Netherlands!

The Dutch made sure with a large secret Cordon Sanitair around me since 1977 that I could never pay everything when they took away my high income of 145.000 euro a year! Also in 2003 by secretly(!) giving me an antipsychotic hidden as a daily baby aspirin 100mg. And they made sure I could not file charges against the rapist of my wife! The police themselves(!) were NOT ALLOWED to make an official document! And they manipulated all evidence, or deleted it, and much more.

I also got 40.000 euro less income since 2009 because of the fact that even in innocent detention my pension and more are blocked assuming I was a criminal!

I could not defend myself in the Netherlands, all lawyers refused to help me and no defense was allowed! And I was forced into exile in Spain as a fugitive, therefore forced to ask for asylum three times with a total 15 months in detention, and another 13+1=14 months innocent detention in the Netherlands after an unfair political trial without a lawyer(nobody present but the judges!).

And on top of that the corrupt KLM Co-Pilot King Willem Alexander lying and blocking the asylum I was offered in the air above America on March 15th, 2017 after President Obama himself intervened in favor of my case.

In detention they stopped my income from my incapacitated insurance and pension for total of around 40.000 euro as a punishment! While I am the victim only defending myself and my defenseless wife with severe dissociation and even an extra emotional personality who has no memory of all the rapes done to her.

And around 2013 I was forced to pay 7000 euro to the rapist of my defenseless wife also, and in 2017 another 8000, or in total I was forced to pay the rapist of my wife 15.000 euro! With no defense during court trials allowed and no lawyer who all refuse to defend me, wrongly assuming I am delusional!

And in Sept 2013 I had to spend almost 10.000 euro for flights and hotels trying to reach Texas! First through Canada and later Mexico because the Dutch several times tried and succeeded(!) to block my travel to reach Canada and Texas for my second asylum request after being innocent sentenced in the Appeal case in Dec 2012! Which are severe human rights violations.

And I lost a 250.000 euro(my saved pension money) since 2004 because I had to fight against my own(!) Dutch State and pay extra costs to detectives, a monthly 2000 euro to my mentally very sick defenseless wife in the Netherlands when I was in exile in Spain, and for the three asylum requests(flights/Hotels), and much more.

Also a group of Dutch people in Jalon, Spain in 2011 stole 300.000 euro from me being hired by the Dutch Criminal Organisation behind this cover-up and conspiracy! I filed charges against them in the Netherlands and in Spain, but heard nothing as is normal in this case. Everybody simply neglects me. With my 300.000 euro, from a book and movie deal, I could have paid all the Spanish taxes easily and raise my pension to a more normal level! And pay for legal help if they dared to help me against the corrupt intimidation by the Dutch King.

See post Filing charges for 3 criminal cases with Minister of Justice, Spain

So therefore I can never alone without help pay the Spanish taxes over 2012, 2013 and now coming 2016. And the Dutch refuse to pay an advance on my damages.

In 2009, 2010 and 2011 I paid around 16.000 euro each year tax(48.000) in Spain although I paid far(!) to much as I was not allowed to deduct my payment to my mentally sick wife of 2000+ euro a month!

Nor my extra costs to defend myself against the Dutch persecution with a 10.000 to reach Texas in 2013, and 7000 in a fine to the rapist of my defenseless wife.

Double taxes in Netherlands and in Spain!

In 2014, 2015 and 2017 I had to pay tax in the Netherlands because I lived there to divorce my wife at last on her(!) request! But Spain wants me to pay double tax for 2014 and 2015. With 2016 soon coming. Because I could not file in time, which is impossible from a jail where I was innocent(!) being the victim of the largest known cover-up and conspiracy in the known history of the Netherlands.

But I was able to pay the tax over 2018 and 2019 in Spain again, but now the last second part of 760,66 euro is impossible because of the stupid Spanish embargo on my new Openbank account and the fact the Spanish stupidly refuse payment by any bank account outside Spain! Which is also against EU regulations and laws.

See also my earlier post Force Majeure Spanish Taxes Ministro de Hacienda!

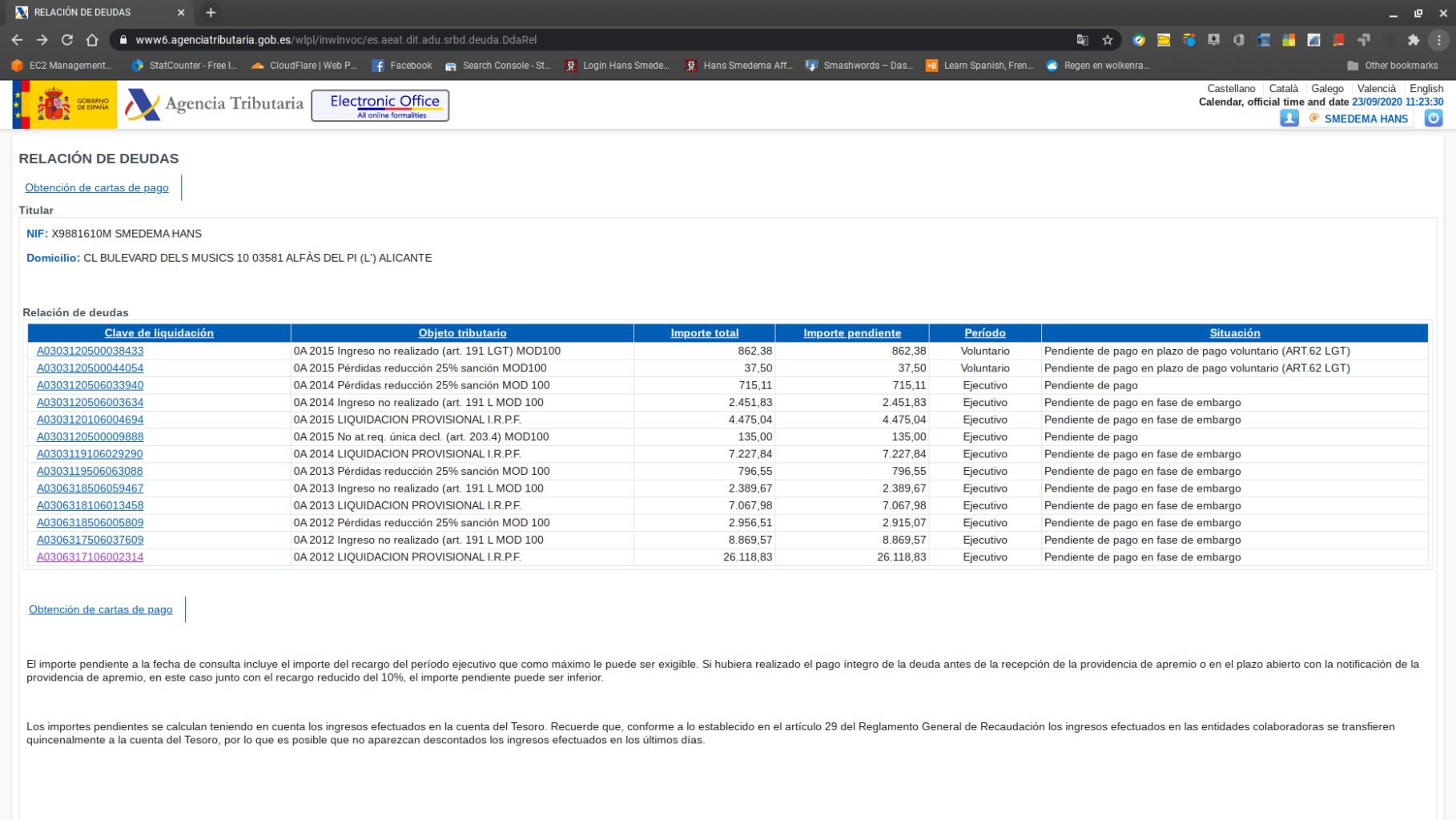

I found with a bit of luck also a list of all the current fines or taxes I would have to pay, including the double in 2014 and 2015 and an absurd over 2012! Never found that list before! And 3 gestor’s are not able to handle a case like mine.

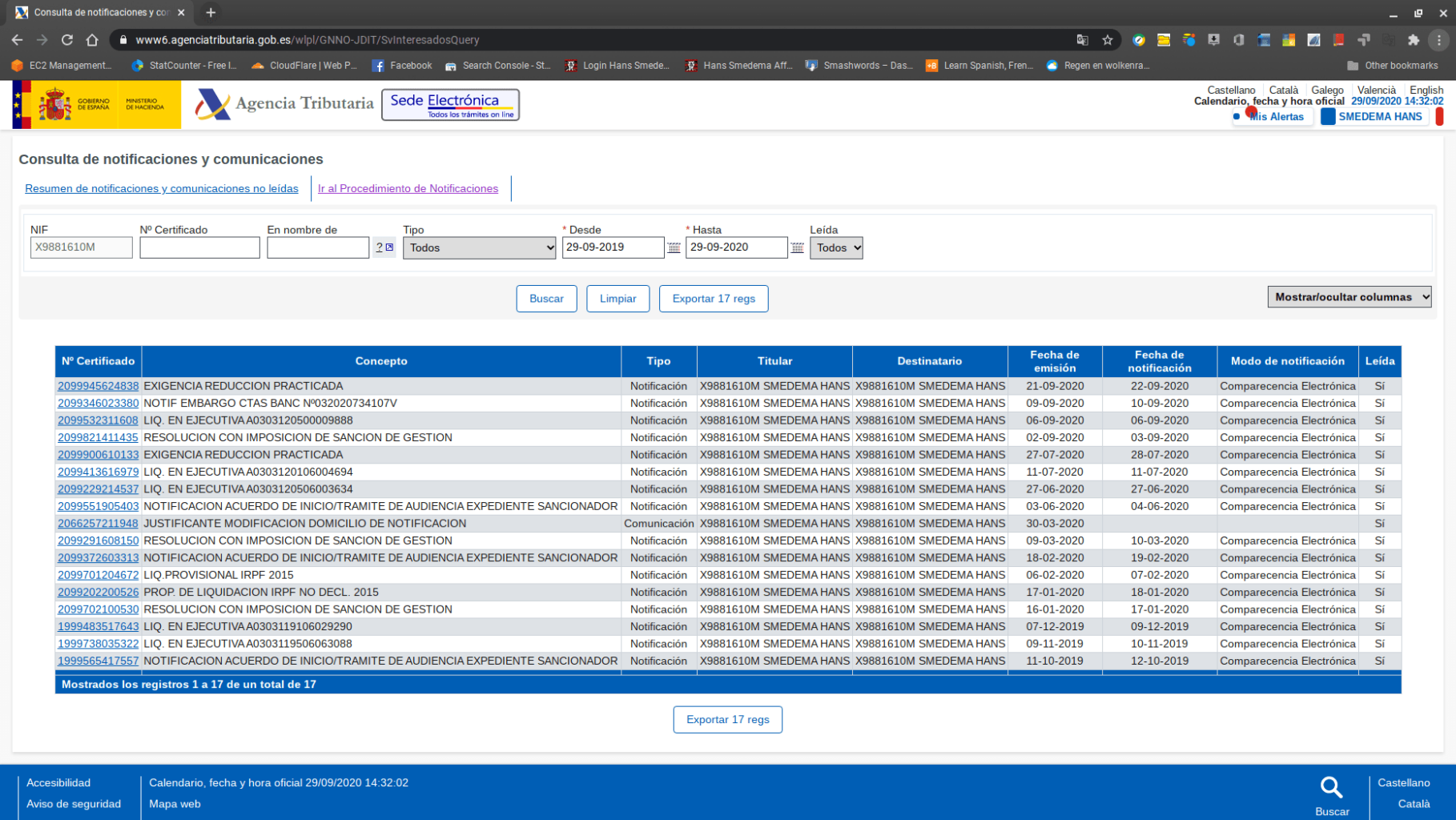

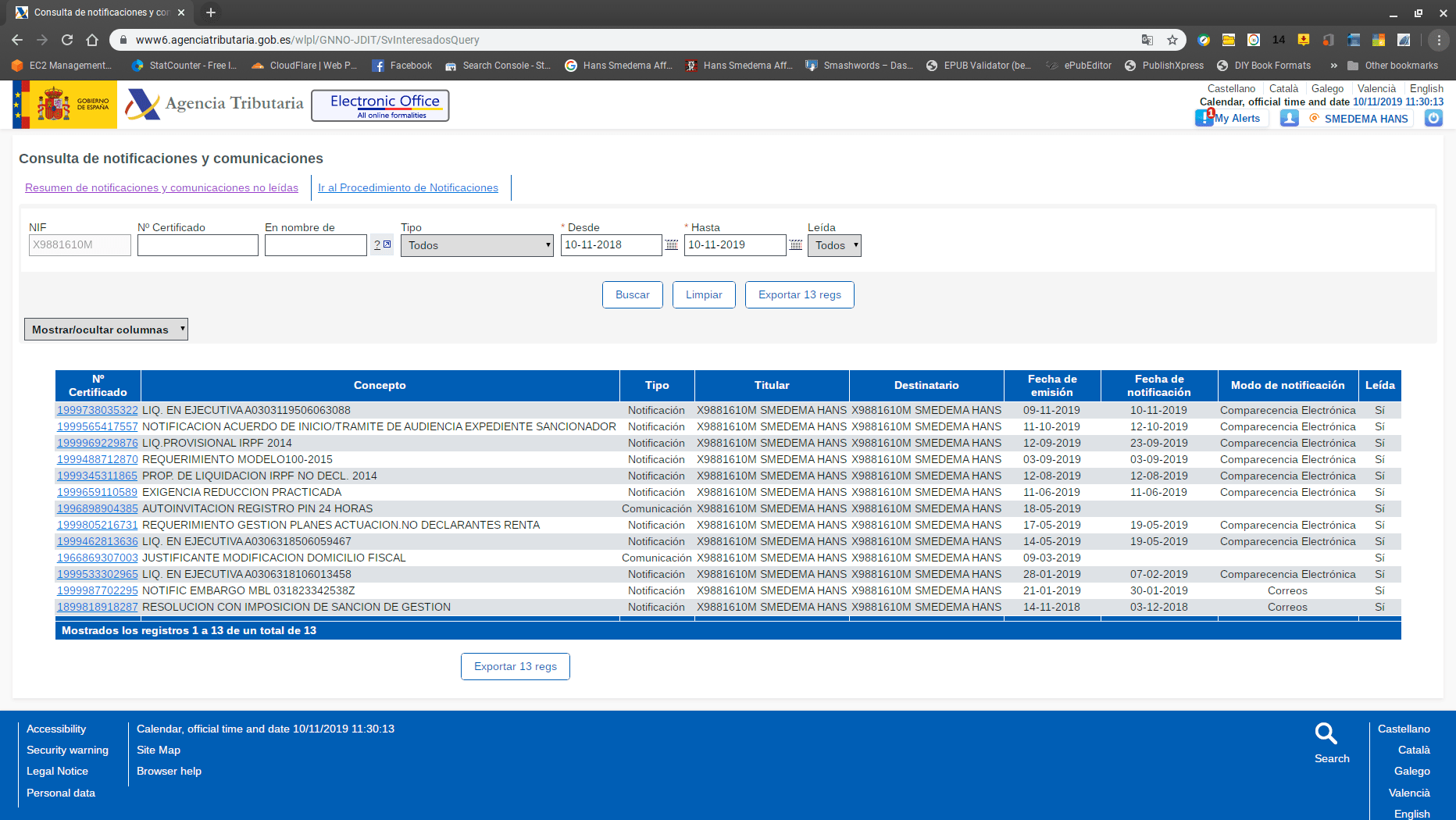

And below that, a list of all the documents they keep sending me also to pay, but being almost broke after 45 years of Dutch persecution, I am not able to pay anymore after paying far to much over 2009, 2010 and 2011. And I do not understand what they mean with all that even in English. Hiring a high level tax lawyer without money will not be possible of course. That would cost at least 5000 euro if they understand my exile situation with extreme high costs and are willing to defend me with that as the context. Simply told I paid too much taxes in Spain and Netherlands.

Taxes much to high 2009, 2010, 2011, 2012, 2013!

But in the years 2009, 2010, and 2011 I paid too much tax as they did NOT deduct the 25.000 euro I paid to my mentally sick wife in the Netherlands! I paid around 16.000 or 40.000 in those 3 years. But without legal help and the Netherlands(family and justice) even denying the fact that my wife had severe dissociation and an extra emotional personality(DIS), I was powerless to fight back. Since 2000 no lawyers dared or were allowed to help me probably based on State Security because of the involvement of the retard Dutch Royals. Also, I did NOT know I secretly got an antipsychotic because they/some assumed I was insane or delusional based on the lies and betrayal from my and her family, my sick wife, including the Dutch Ministry of (In)Justice.

How do you defend yourself against that all without any legal high-level help?

What the Dutch did to me since 1972!

For anyone interested in my ordeal reed this long unbelievable summary:

Timeline all most crucial events!

Telephone answer from Administracion de Benidorm

Payment is only(!) possible when I make an appointment in person with Agencia Tributaria and ask for a special form, and have somebody from my family, which I don’t have, or a stranger(!) to pay my tax after I pay them cash! Which I refuse to do, of course, I am not involving others in this Spanish tax problem.

Spain now put twice an embargo on two bank accounts, and both cancelled therefore my account!

Paying simply with my Dutch Rabobank account or Dutch credit card is NOT ALLOWED BY SPAIN ITSELF.

I will have to use now my credit card to collect cash from an ATM and pay in cash at a Spanish bank. And try to save that money before in June 2021 I will have to pay tax again over 2020! Which will also be impossible with no Spanish bank account! Probably only in cash possible without a Spanish Bank account!

Received a Model 102 tax form. Paid!!!

Received a Model 102 tax form to pay cash the last 760,66 euro cash at any collaborating(!) bank from Guillermo Barros Gallego Departemento de Recaudacion! I will now pay before Nov 5th, 2020 the last part! That leaves only 20012/13/16 as problems!

On Oct 30th, 2020 I was after more trouble with hours work to pay cash at the Sabadell Banco in Albir! What a relief at last!

UNBELIEVABLE WHY THE SPANISH MAKE PAYING TAXES SO DIFFICULT! ALMOST IMPOSSIBLE!

Here my letter to Administracion de Benidorm from Sunday, Sept 27th, 2020 with a very fast verbal answer on Monday!

Complaint!

Administración de BENIDORM

GESTION TRIBUTARIA

AV BENIARDA, 2

03502 BENIDORM (ALICANTE)

Español, vea abajo Inglés!

El Albir, Sept 27th, 2020,

Concerns: Embargo on Openbank Account makes paying a second payment of 760,66 euro impossible!

Why do you make it impossible to pay Spanish taxes?

- My Openbank account specially made to pay Spanish taxes and other Spanish costs like Internet/Dragonet and Mobile Simyo, was closed as a result of your embargo. Earlier in 2018 you did the same with Bankinter.

- Trying to pay directly the second payment of 760,66 from another Spanish Account with N26 failed as it is not on your list of collaborating Banks.

- Trying to pay directly with my Dutch Rabobank account failed also as you do not accept foreign/EU banks at all!

- Trying to pay with my Credit card from the Dutch Rabobank account failed also as you refuse to accept those foreign/EU credit cards also!

- Trying to change the payment to a cash payment form at a Spanish Bank(Caja) also failed as that is NOT an option at all in your Agencia Tributaria system!

- So I revoked(!) the second payment for Nov 5th stating paying was impossible, but I can pay the 760,66 if you let me or do not block me from doing so!!!

Now 3 Gestors refuse to help my special case of persecution by the Netherlands against my person taking away my civil rights, taking away my income, taking away part of my pension, and causing high extra costs to defend myself by asking for Asylum in America three times in 2009, 2013/14 and 2016/17.

When I was in the air on a KLM Plane Dutch King Willem Alexander as KLM Co-Pilot lied and criminal(!) refused to confirm the fact that I accepted(!) the offered Asylum by Judge Rex J. Ford on March 15th, 2017.

The Dutch made sure I can never pay the normal taxes over 2012, 2013 and 2016. All other years are paid in the Netherlands or 2018 and 2019 now in Spain if you let me pay the last 760,66 euro!

The 3 gestors are

- A Casa in San Fulgencio

- Duran in Albir

- Perez in Albir

The last one Perez in an email a few days ago said that this case is too difficult for them and I should look for a high level International Lawyer organisation. But that will cost many thousands I simply do not have! 5000 to 10.000 euro?

Making an appointment(cita) will not help as I do not speak enough Spanish nor do I understand all the difficult terms you use in your Agencia Tributaria system. And I know you do not have any English speaking employees or even Dutch, if they could explain my options now.

What will happen?

I am entitled to a large (millions) damages payment from the Dutch, but for that I will first need a lawyer who all cowardly refuse my case with the Dutch King and Dutch State Security involved. So paying you will be easy if you can assist me in finding someone who forces the Dutch State to pay! It could very well be that you legally have the right(using tax laws?) to make a claim against the Netherlands?

I made a financial deal over a debt of 5000 euro with the Dutch tax to pay 72 euro a month for two years, which brings my current income to a Dutch social minimum allowed in the Netherlands.

I already told you I had to pay taxes in the Netherlands over 2014, 2015, 2017! Over 2016 I still have to pay Spanish tax, but can not find a way to file those 2016 model 100 tax. I could not file that year 2016 as I was innocent(!) in detention from 30 Sept 2016 until April 5th, 2018 and had no money at all.

I estimate it will be at less than 1900 euro which I cannot pay at the moment without first getting the Dutch to pay my millions of damages.

So, to pay the second 760,66 euro I will need a cash(caja) Model 100/102 form! Or accepting a foreign Dutch/EU credit card! Can you send that or direct me how to do that in your system?

How do we solve this?

With kind regards,

Hans Smedema

Español

El Albir, 27 de septiembre de 2020,

Preocupaciones: El embargo de la cuenta Openbank imposibilita el pago de un segundo pago de 760,66 euros !

¿Por qué hace imposible pagar los impuestos españoles?

- Mi cuenta de Openbank hecha especialmente para pagar impuestos españoles y otros costos españoles como Internet / Dragonet y Mobile Simyo, se cerró como resultado de su embargo. A principios de 2018 hiciste lo mismo con Bankinter.

- Intentar pagar directamente el segundo pago de 760,66 desde otra Cuenta española con N26 falló al no estar en tu lista de Bancos colaboradores.

- ¡Al intentar pagar directamente con mi cuenta holandesa de Rabobank también falló, ya que no acepta bancos extranjeros / de la UE en absoluto!

- ¡Intenté pagar con mi tarjeta de crédito de la cuenta holandesa de Rabobank también falló porque usted se niega a aceptar esas tarjetas de crédito extranjeras / de la UE también!

- Intentar cambiar el pago a una forma de pago en efectivo en un banco español (Caja) también falló ya que NO es una opción en su sistema de Agencia Tributaria.

- Así que revoqué (!) El segundo pago para el 5 de noviembre indicando que pagar era imposible, pero puedo pagar los 760,66 si me dejas o no me bloqueas.

Ahora 3 Gestors se niegan a ayudar en mi caso especial de persecución por parte de los Países Bajos contra mi persona que me quita los derechos civiles, me quita los ingresos, me quita parte de la pensión y me causa altos costos adicionales para defenderme al pedir asilo en América veces en 2009, 2013/14 y 2016/17.

Cuando estaba en el aire en un avión de KLM, el rey holandés Willem Alexander mientras el copiloto de KLM mintió y el criminal (!) Se negó a confirmar el hecho de que acepté (!) El Asilo ofrecido por el juez Rex J. Ford el 15 de marzo de 2017 .

el holandés se aseguró de que nunca podré pagar los impuestos normales durante 2012, 2013 y 2016. Todos los demás años se pagan en los Países Bajos o 2018 y 2019 ahora en España si me deja pagar el último 760,66 euros!

Los 3 gestores son

- A Casa en San Fulgencio

- Durán en Albir

- Pérez en Albir

El último Pérez en un correo electrónico hace unos días dijo que este caso es demasiado difícil para ellos y debería buscar una organización de abogados internacionales de alto nivel. ¡Pero eso costará muchos miles que simplemente no tengo! 5000 a 10.000 euros?

Hacer una cita (cita) no ayudará ya que no hablo suficiente español ni entiendo todos los términos difíciles que usa en su sistema de Agencia Tributaria. Y sé que no tiene ningún empleado que hable inglés o incluso holandés, si pudieran explicar mis opciones ahora.

¿Lo que sucederá?

Tengo derecho a un pago grande (millones) de daños por parte de los holandeses, pero para eso primero necesitaré un abogado que rechace cobardemente mi caso con el rey holandés y la seguridad del estado holandesa involucrada. ¡Pagarle será fácil si puede ayudarme a encontrar a alguien que obligue al Estado holandés a pagar! ¿Podría ser que legalmente tenga derecho a presentar una demanda contra los Países Bajos?

Hice un trato financiero sobre una deuda de 5000 euros con el impuesto holandés para pagar 72 euros al mes durante dos años, lo que eleva mis ingresos a un mínimo social holandés permitido.

¡Ya les dije que tenía que pagar impuestos en los Países Bajos durante 2014,2015,2017! Durante 2016 todavía tengo que pagar impuestos españoles, pero no puedo encontrar la manera de presentar esos impuestos modelo 100 de 2016. No pude presentar ese año 2016 porque era inocente detenido hasta el 5 de abril de 2018 y no tenía dinero en absoluto. Calculo que serán por lo menos 2000 euros, que no puedo pagar en este momento sin antes que los holandeses paguen millones en daños.

Entonces, para pagar el segundo 760,66 euro, necesitaré una caja Modelo 100/102 en efectivo. ¡O aceptar una tarjeta de crédito extranjera holandesa / europea! ¿Puede enviarme eso o indicarme cómo hacerlo en su sistema?

¿Cómo resolvemos esto?

Saludos cordiales,

Hans Smedema